Beijing, China – Plug-in electric car sales in China saw a significant rise in June, achieving the second-highest monthly volume on record and capturing a remarkable 49.9% market share. This milestone indicates that nearly half of all new passenger cars in China are now rechargeable, a level unmatched by Europe and the United States.

According to EV Volumes data shared by researcher Jose Pones, 875,000 new passenger plug-in electric cars were registered in China in June, marking a 23% increase from the previous year. The growth was primarily driven by plug-in hybrids, with all-electric car registrations seeing a modest 1% year-over-year increase to approximately 482,500 units, accounting for about 55% of the total plug-in volume. In contrast, plug-in hybrid electric vehicles (PHEVs) surged by an impressive 70% year-over-year, reaching around 393,000 units, or 45% of the plug-in market.

June 2024 Plug-In Car Sales Breakdown:

- Battery Electric Vehicles (BEVs): ~482,500 units (+1% YoY), 28% market share

- Plug-In Hybrid Electric Vehicles (PHEVs): ~393,000 units (+70% YoY), 22% market share

- Total Plug-In Sales: 875,000 units (+23% YoY), 49.9% market share

During the first half of 2024, over 4.26 million new plug-in electric cars were registered in China, a 31% increase year-over-year, representing about 43% of the total car market.

January-June 2024 Plug-In Car Sales Breakdown:

- BEVs: ~2.55 million units, 25% market share

- PHEVs: ~1.69 million units, 18% market share

- Total Plug-In Sales: 4,269,398 units (+31% YoY), 43% market share

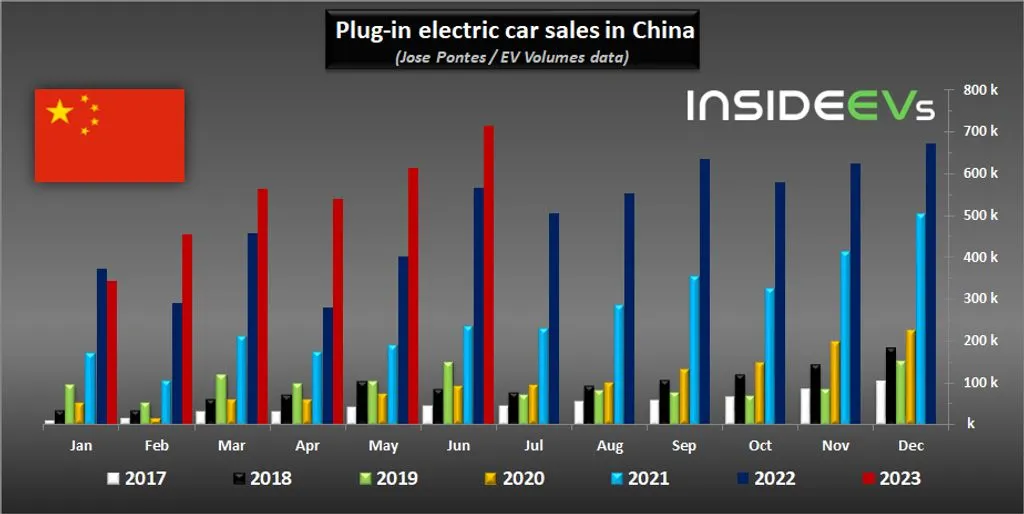

In 2023, China registered more than 8 million new plug-in electric cars, a 46% increase from 2022, which accounted for about 37% of the total car market. With a strong start in 2024, annual plug-in sales are expected to reach 10 million units, with the majority of sales occurring in the second half of the year.

Top-Selling Models in June 2024:

- BYD Song: 52,227 units

- Tesla Model Y: 44,110 units

- BYD Qin Plus: 38,918 units

- BYD Seal: 30,578 units

- Nissan Sylphy: 23,864 units

The BYD Song has dominated the market in the first six months of 2024, maintaining its position as the top-selling model.

January-June 2024 Top-Selling Plug-In Models:

- BYD Song: 292,000 units

- Tesla Model Y: 210,810 units

- BYD Qin Plus: 154,000 units

- BYD Yuan Plus: 111,380 units

- Wuling Hongguang Mini EV: 83,288 units

BYD continues to lead the Chinese plug-in market with a 30.8% share, rising to 32.9% when including its satellite brands.

Top Brands by Market Share (January-June 2024):

- BYD: 30.8%

- Tesla: 6.8%

- Li Auto: 4.6%

- SGMW: 4.6%

Top Automotive Groups by Market Share (January-June 2024):

- BYD Group: 32.9%

- Geely-Volvo: 7.9%

- Tesla: 6.8%

- SAIC: 6.7%

As China continues to lead the global transition to electric vehicles, the surge in plug-in car sales highlights the country’s commitment to reducing emissions and promoting sustainable transportation.